ACCC and News Corp vs Google and Facebook

- Feb 22, 2021 modified: Mar, 18 2025

ACCC and News Corp vs Google and Facebook

How misplaced is the pressure on the Australian Competition and Consumer Commission (ACCC) watchdog from news organisations such as News Corp to force Google into paying News Corp for the privilege of Google directing search engine traffic towards News Corp's online platforms and articles through rankings on web searches?

News media bargaining code

The results seem to be just money moving from Google and Facebook to News Corp and Channel Nine. No addressing the power imbalance. No requirements for News organisations to actually spend the money on journalists. No change to Google search results or Facebook news feeds. Just money moving!

It's bizarre given web searches on many of the largest news platforms like News Corp lead us to a user-pay firewall anyway.

So it's debateable whether News Corp and others should even be included in Google search engine results in the first place, let alone Google having to give financial concessions or payments to News Corp for directing potential users or customers to News Corp products and therefore News Corp advertisers.

Wouldn't it be better if all (mainly foreign) news platforms and all social media (digital) platforms just paid a fair share of tax in Australia?

"Google Australia reaped over $1 billion in total revenue, but paid just $37 million in tax"

source au.finance.Yahoo.com

"News Australia Holdings revenue over 5 years = $13.9B, taxable income = $246M"

source https://twitter.com/michaelwestbiz/status/1215481330072313856

Walkley award winning cartoonist @moir_alan Feb 22 2021

Jeff Jarvis:

"Facebook called the bluff of Murdoch and his politicians."

"If there were any sense in this the platforms (Google Facebook) would be owed money by the publishers. The platforms are sending the publishers traffic."

"It has never made any sense at all. It is blackmail on behalf of the media companies cashing in on their political capital."

"This is not about paying for news content. All that facebook and Google do is show a headline so they can link to the publishers and send those publishers audience, people users, us."

ABC Radio National Download This Show

Check 8.22 - 22.27 of Episode Apple vs Epic, Google vs ACCC

Advertising Revenue per $100 spent

| Platform | $ |

|---|---|

| $53 | |

| $28 | |

| Everyone else | $19 |

Counter Threat

As a counter threat to the ACCC's perceived interference, Google warns:

"[you] could expect dramatically worse, Google searches and YouTube responses"

However this threat by Google appears to be largely designed to get the Google and especially the YouTube user base fighting Google's case for them through a social media campaign, backlash and petition against the ACCC and proposed legislation.

Google News Media Bargaining Code Video

"We are not against a new law, but we need it to be a fair one."

Australia's first Pentecostal Prime Minister, Scott Morrison, calls misuse of social media the work of 'the evil one'. refer Separation of Church and State Australia

Change.Org petition - August 2020:

#OurYouTube

The Australian Government has proposed legislation which, if enacted, will enable large news publishers to effectively suppress any and all content they disagree with.

The bill is called the "News Media Bargaining Code" — and it must be stopped immediately.

As it stands, this proposed bill is an assault on Australia's democracy.

If online platforms like YouTube and Google are legally mandated to disclose the inner workings of their systems to large news publishers, then Parliament would effectively be enabling these large news publishers to unfairly rank their content at the top of the YouTube and Google search results.

As a direct result, large news corporations would effectively be able to suppress articles, videos, opinions, ideas, and all other online content they disagree with (like videos from YouTube creators, for example).

If that wasn't dangerous enough, the proposed law also jeopardizes the privacy rights of YouTube viewers by requiring that YouTube hand-over vast amounts of private user-data to these large news companies.

Google also claims:

"They [News Corp] want a few other things so they want for example, Google and Facebook to give media publishers 28 days notice if they're going to change that sort of algorithms in a way that might affect the display of news."

The Case for SEO

SEO (Search Engine Optimisation) is largely misunderstood by many. The contribution of SEO has lead to better search results, a more efficient Google and constant innovation in search. SEOs essentially try to manipulate search results in their favour (to improve clicks to websites). It is at its best largely a symbiotic relationship between Google and SEO companies. The results are better search results and better content. Google is very good at determining quality, original content from valid sources. SEOs work at making their sites those sources.

Handing algorithms to News organisations (as ACCC has proposed) works against the nature of the competitive nature of the web.

Special Sauce

Google's 'special sauce' is its algorithms that place the most worthy content high up on its search pages. So this would be a world-first precedent where certain organisations such as News Corp under the direction of the Australian Government are to be given 'free kicks' that are not necessarily merited, while their corporate competitors are awarded none, no matter how good their product.

Then again, major multinational News organisations already have a history of using technology to benefit their bottom lines without any recognition of or concerns regarding the legality, ethics or fairness of such tactics - take for instance their illegal hacking of mobile phones of people living and dead as 'click bait' to feed News Corp's news cycle.

"The News International phone-hacking scandal was a controversy involving the now-defunct News of the World and other British newspapers owned by Rupert Murdoch."

source a https://en.wikipedia.org/

So these 'mobs' involved in phone hacking scandals are now seeking Australian Government assistance to access and control a competitor's Intellectual Property?

"you need to be a media publisher of a certain size to bargain full stop"

These proposals to make Google pay are not going to help small, local media producers. They are just for the big media players, questionably in consort with a government whose political party wing has arguably benefited greatly from News Corp's media bias.

ABC Media Watch 2020 - Episode 30

Making big tech pay (31 Aug)

https://www.abc.net.au/mediawatch/episodes/google/12612756

Pay Fair Share of Tax on Sales Revenue

How about the 'novel' idea of making News Corp, Google (including Youtube) and other digital platforms - Apple, Facebook, Amazon, Netflix, etc - just pay their fair share of tax on their revenue from sales in Australia?

Google Australia's latest financial accounts show it paid almost $100 million in tax in 2019, which is far higher than previous years.

But the tax paid on profits needs to be considered in the context that the company did not count $4.8 billion in gross revenue locally, mostly from advertising.

The Federal Government's tougher anti-avoidance laws, aimed at recouping more tax from multinationals, saw a number of multinationals restructure their tax affairs to pay more tax locally than they have in past years.

However, the laws have not been able to stop the legal practice of companies like Facebook and Google channelling hefty amounts of advertising revenue via low-tax countries such as Singapore.

This is why the OECD, together with the G20, has been working on a plan to tax digital companies.

But that work has been delayed due to the coronavirus pandemic, and there are fears it could take years before governments agree on, and implement, a solution.

The delay has resulted in some countries already moving to tax digital companies' sales, rather than their profits, in a huge departure from long-standing tax principles.

Google has long considered itself merely as "agent" facilitating sales locally.

This means that while Google Australia counts the commission it earns on its lucrative advertising sales as revenue, the majority gets attributed through Singapore.

Nassim Khadem, 18 May 2020 https://www.abc.net.au/news/2020-05-18/google-pays-more-tax-but-still-makes-billions-in-singapore/12254448

Trump Threatens France

Google's Vice President - government affairs and public policy - Karan Bhatia, has argued the tech giant supports the move toward a new global framework for how multinational companies are taxed.

But he has also warned a feud between the United States and France over taxing US tech giants could extend more widely.

In July, the French Senate approved a 3 per cent levy that will apply to revenue from digital services earned in France by companies with more than 25 million Euros in French revenue and 750 million Euros worldwide.

The tax, widely referred to as the GAFA tax, which stands for Google, Apple, Facebook, and Amazon, was expected by France's Finance Ministry to raise 500 million Euros a year.

The Washington-based Tax Foundation's Daniel Bunn thinks the OECD delay raises the potential for governments to move ahead with unilateral measures.

"A tax and trade war driven by those unilateral measures would be incredibly harmful to the global economy... The back-and-forth between the United States and France ... may return with a vengeance." France's unilateral move invited a strong backlash from the US, with President Donald Trump threatening America would retaliate by imposing tariffs on French wine.

Google Search Results - increasingly taking you nowhere

While Google's revenue from advertisers continues to increase, you may put in a search question regarding an historical event; or request scientific and technical information on a specific topic; or attempt to clarify a disputed fact; or pose a general knowledge question in your search and all that 'pops up' is a snippet of information in a Google answer to your question and perhaps a reference to the source of that information.

However, Google does not direct you to the actual website that is the source of the information. That particular website creator misses out on a click-through or visitor to their website but as they are not paying Google to advertise their site, this seems of little concern to Google.

"interesting to think about Google's sort of history of using its own platform to lobby and be an activist I think this is the first time we've seen such a thing in Australia"

"... Google is obviously hoping that YouTubers around the world have even asked international YouTube creators to make submissions to the ACCC which is an interesting move."

"...I don't quite know who would be mobilized for Facebook in quite the same way, they don't have a creative platform that has enough goodwill to write letters and submit them to a competition regulator in Australia"

Facebook respond with an audio statement

refer ABC Radio National Facebook's threats 'abuse of monopoly power', Nine boss says

Hal Crawford, ex news boss at ninemsn: content, social media and PR advice.

"in terms of the benefits facebook derive from it, they do get some benefit, it is just one small part of the content Facebook has and I think that is a perspective the news industry does not really have."

"If we are going to tax Google and Facebook let's be honest about that and tax them and redistribute that money."

"I don't think this legislation is good at all."

source: ABC RN 3rd Sep 2020

"I don't think this legislation is good at all"

"Microsoft fully supports the News Media Bargaining Code"

"...Microsoft will ensure that small businesses who wish to transfer their advertising to Bing can do so simply and with no transfer costs."

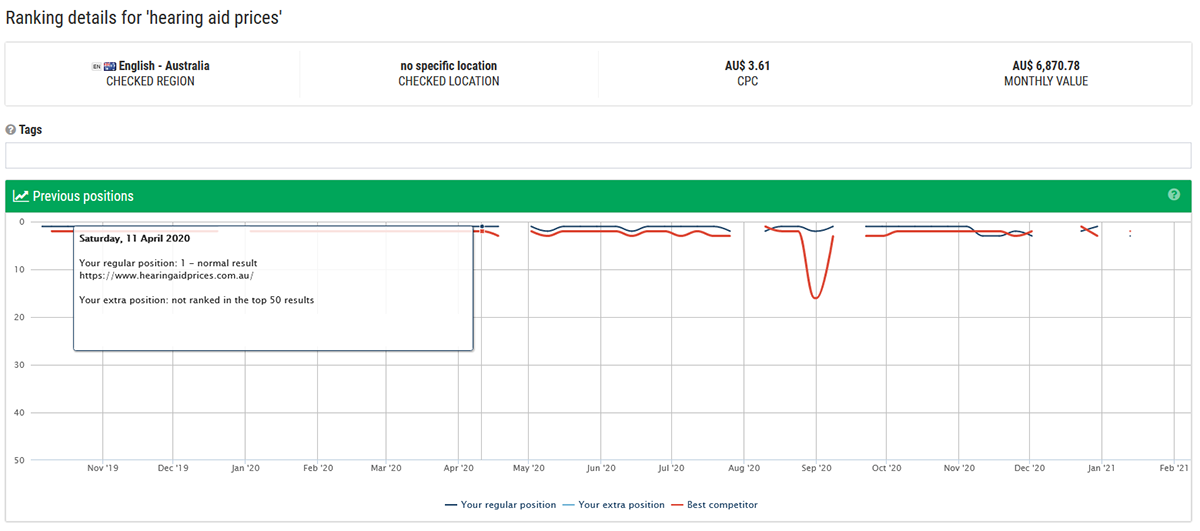

Bing too volatile to fill the gap if Google leaves Australia

There is a reason Google has an estimated 94% and Bing 4% share of the Australian search market. Bing is no where near as refined, sophisticated or intuitive as Google. This is coming from the perspective of a Gold Coast based SEO.

Analysing the above data you can see massive valatility in the organic search results in Bing. It tracks 2 leading sites on a competitive search term. Both sites go from top rankings to completely disappearing from the radar.

Is this what Australian searchers can look forward to if Google removes access to its search engine?

Conclusion

There are some significant issues with Google - however the notion of handing over Google revenue to a company like News Corp, with its history of bias and right-wing reporting, phone hacking scandals, denial of climate change and at times, racist and misogynist ideologies in its editorials, does not sit well for many. News Corp are simply not good enough as global citizens to warrant this kind of financial 'windfall' through the instrument of the Australian Government.

All digital platforms operating in Australia who derive revenue from advertising in Australia and from sales to Australians should be held legally accountable to pay their fair amount of tax in Australia.

G7 Deal to Tax Big Tech - multinationals

June 5 2021: US Treasury Secretary Janet Yellen has been working behind the scenes to put the deal together:

"End the race-to-the-bottom on corporate taxation and ensure fairness for the middle class and working people in the US and around the world."

1. Tax the profits of multinations in the countries they sell their products or services

2. Establish a minimum rate for corporate tax (eg 15%)

A global minimum tax would help the global economy thrive by leveling the playing field, capturing some tax on the very highest profits on the largest multinations.

This needs to be spread not to just the G7 countries but also to the G20 countries.

Using a tax haven to get the tax rate below 15% will not help these multinationals under this new rule.

At the moment companies like Facebook can set up local branches in countries that have relatively low corporate tax rates and declare profits there.

Originally Published 20 Aug 2020.

Search News Articles...

2026

Recent Articles

Keywords no longer as visible in GSC

- Jan 12 2026

- /

- 338

Unique Web Systems Matter in a World of Sameness

- Dec 26 2025

- /

- 251

Most AI Websites Fail to Rank

- Nov 18 2025

- /

- 500

Sitemap.xml Best Practices

- Oct 14 2025

- /

- 2300

Fake Reviews on Google My Business

- Oct 07 2025

- /

- 668

Sending Emails from Code

- Sep 17 2025

- /

- 727

US Tariff Shifts Undermining eCommerce

- Sep 05 2025

- /

- 912

Small Business Success Formula

- Aug 23 2025

- /

- 671

Do Strong CTAs Help or Hurt Your Website?

- Jul 31 2025

- /

- 894

AI Crawlers vs Search Crawlers

- Jul 04 2025

- /

- 1207

View All News Articles

Categories

A Gold Coast SEO and Web Developer